Each year, the National Financial Educators Council (NFEC)¹ shares the results of their annual financial literacy testing data.

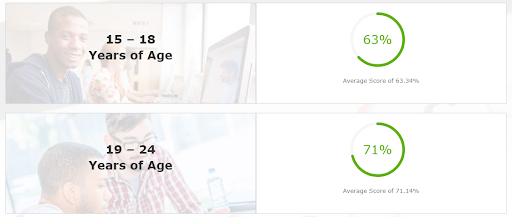

According to the latest data, the average score of incoming first-year students who just graduated from high school is just 63 percent.

Although older students between 19 and 24 do slightly better at 71 percent, this score is barely above passing.

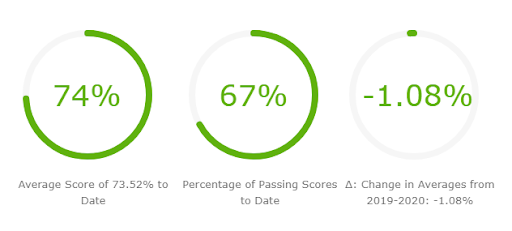

NFEC also states that the average test score for participants of all ages is 67.93 percent, slightly lower than scores two years ago.

Without financial literacy, students do not have the necessary information to achieve financial wellness. Students combine knowledge with action to create better financial habits and make sound financial decisions.

Related article: 4 Innovative Ways to Engage Students in Financial Wellness

Here are the results of the four tests and what they mean for your students:

National Financial Literacy Test

The main test offered by NFEC looks at ten general areas of finance, including financial psychology, credit and debt, accounts and budgeting, skill growth, income, business relations, long-term planning, risk management, investments, and social enterprise.

However, unlike many financial literacy tests, NFEC goes beyond looking at knowledge acquisition and determining financial wellness.

They do this by evaluating three financial wellness components:

- Knowledge: What do students know about specific financial topics?

- Motivation to learn: Do students understand how financial matters will affect them?

- First Steps: Can students recognize what they should do first based on what they have learned about a financial topic?

With an average test score of 71 percent for younger students, colleges and universities can rest assured that their student population will need help achieving financial wellness.

Related whitepaper: Financial Literacy Study Compilation

The Financial Foundation Test

The Financial Foundation Test² is a more entry-level test that looks at a student’s ability to:

- Buy a car

- Rent a house or apartment

- Take out a loan

- Pay off debt

Although these questions are entry-level, one out of three people fail the test, and the average score for 15 to 18-year-olds was just 58.67 percent, which is significantly lower than the average score overall.

This means that students living on their own for the first time do so without even a rudimentary understanding of financial topics they will need to tackle.

The Student Loan Test

The Student Loan Test³ is taken by students getting ready to go to college or currently in college.

This test determines how prepared these students are to make appropriate student loan decisions.

Based on the most recent statistics4, a majority of your students will take a student loan:

- 66 percent from public colleges

- 75 percent from private, nonprofit colleges

- 88 percent from for-profit colleges

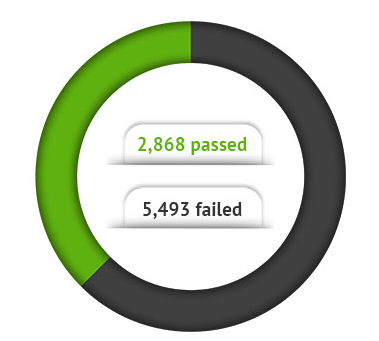

Despite the number of students needing loans, two out of three students fail the student loan test with questions on loan options, loan terms, and loan repayment.

These students are making big financial decisions that will impact them for years to come without the appropriate knowledge to do so.

Related whitepaper: Diplomas, Debt & Default: How Financial Wellness Helps College Student Break the Cycle

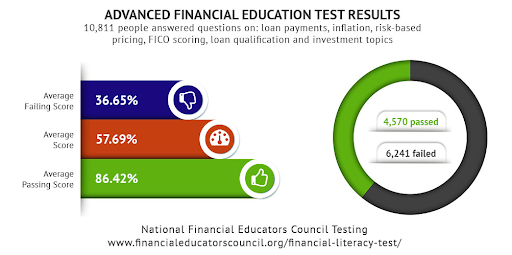

The Advanced Financial Education Test

The Advanced Financial Education Test5 goes beyond basic financial topics, including credit scores, investing, retirement, and inflation.

As you would imagine, since students are unlikely to pass entry-level financial tests, their scores on the advanced test would also show issues, though the NFEC did not break these scores down by age.

How College Financial Wellness Programs Can Help

The data may look discouraging, but there is a solution.

Colleges and Universities are in a good position to offer their students a holistic financial wellness program. Such programs provide students access to needed information, tools, tips, and behaviors to increase financial wellness.

iGrad data shows that students who use a financial wellness program improve their financial health by saving money and learning to pay off credit card balances.

If financial literacy program best practices are followed, colleges typically see higher graduation and student retention rates, and lowered student loan delinquency and default rates.

Programs like iGrad provide students with:

- Financial Topic Knowledge: Students can learn about budgeting, student loans, getting credit, and more through courses, articles, tools, and calculators.

- Financial Understanding: Students understand how making financial decisions can affect them now and in the future and why it is important to develop good financial habits early.

- Action: Students learn the steps to take to put their knowledge to work, from creating a budget to determining an appropriate student loan amount to increasing their credit score.

The goal of higher education is to help students prepare for their future. Offering a financial wellness program fits easily within that goal.

To learn more about how iGrad provides financial literacy programs to colleges, watch our demo video here

1 - https://www.financialeducatorscouncil.org/national-financial-literacy-test/

2 - https://www.financialeducatorscouncil.org/financial-foundation-test-results/

3 - https://www.financialeducatorscouncil.org/student-loans-financial-education-test-results/

4 - https://studentloanhero.com/student-loan-debt-statistics/

5 - https://www.financialeducatorscouncil.org/advanced-financial-education-test-results/