Colleges and universities want to help their students achieve financial wellness.

This means students need to experience less financial stress, more financial stability, and more financial options.

For students to become financially well, they must be given the knowledge and ability and develop the desire to make intelligent financial decisions that help them live a happy life within their means.

When institutions of higher learning help their students achieve financial wellness, they also create financial wellness for themselves.

One of the easiest ways to help students is by offering a holistic financial wellness program that provides them with the knowledge, tools, and tips to make needed changes and create strong financial habits.

Here are seven outcomes colleges and universities have experienced by offering a student financial wellness program:

1. Decreased Dropout Rate

Approximately a third of students1 who begin at a four-year learning institution do not complete their degree. Of those that drop out, nearly half2 do so due to financial issues.

Although this is a quick fix, ultimately, students experience more financial issues from being a college dropout, including student loan debt and lower earning power.

Providing financial wellness can provide students with information on:

- Budgeting

- Debt reduction

- Student loans

- Available scholarships

- Other financial assistance

The knowledge and skills learned will help many students stay in school.

For a deeper dive, check out How Financial Wellness Programs Prevent College Dropouts

2. Decreased Student Loan Defaults

The Financial Literacy and Education Commission3 found that most students don’t understand the loans they take out, nor do they understand how repayment works.

However, when WGU Tennessee4 began providing a financial wellness program, their students reduced student loan debt by 40 percent and brought their loan default rate to 4.1 percent, almost half the national rate.

By providing a student financial wellness program, you can help students:

- Understand all aspects of financial aid

- Find alternative funding sources for loans

- Compare career salaries to student loan repayment

- Create a budget that helps fill the gaps between the costs of an education and current cash flow

- Understand what happens to student loans if they drop out of school

- Learn how and when student loan repayment begins

- Determine how student loan debt will impact them in the future

3. Increased Credit Scores

Having a strong credit score is important to students, especially as they graduate and begin their lives outside a school setting. Higher credit scores allow students to:

- Access better mortgage and automobile loan rates

- Secure credit cards with better rewards and interest rates

- Be approved for off-campus housing rentals

- Waive utility security deposits

iGrad's partner company, Enrich, found in its Financial Wellness Behavior Change Data that credit scores went up an average of 25.51 points for Enrich platform participants after 15 months.

According to the Bankrate Mortgage Calculator5, this could easily affect the student’s ability to find a home loan.

4. Decreased Financial Stress

Without a doubt, most of your student population experiences financial stress.

One survey6 found that 7 out of 10 students felt financial stress during the school year. What are they worried about? 3 out of 5 worry about paying for school, while nearly half worry about paying day-to-day expenses.

Unfortunately for colleges and universities, students under financial pressure often feel forced to make difficult choices:

- Nearly a third neglect their studies

- Nearly 30 percent reduces their class load

- 16 percent quit taking classes

- 14 percent transfer to another institution

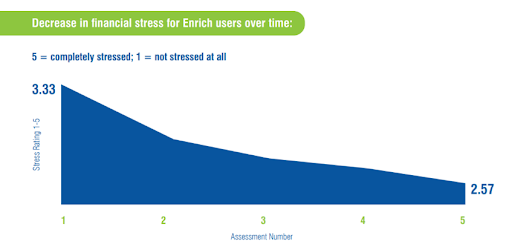

The Enrich study, found that in just one year, participants using the program had reduced financial stress levels.

Related Article: 5 Signs That Financial Stress Is Impacting College Students and How Financial Wellness Can Help

5. Improved Student Health

According to the National Institute of Health (NIH)7, financial stress does more than wreak havoc with a student’s education. Such stress can also cause mental and physical issues.

Of those most concerning for a college setting include:

- Anxiety

- Depression

- Eating disorders

- Sleep disturbances

- Substance abuse

Students that don’t resolve this stress during adulthood can also find themselves experiencing heart disease, high blood pressure, cancer, stomach issues, and diabetes.

By helping students reduce their financial stress, you can help them maintain better physical health now and in the future.

Related article: How to Improve Student Mental Health Through Financial Wellness

6. Increased Emergency Savings

A recent study by College Finance8 found that 60.8 percent of college students are not saving for emergency expenses.

However, being prepared for unplanned expenses is critical for college students because they often do not have the income necessary to cover financial issues when they arise.

By having an emergency fund, students will:

- Be prepared

- Practice good financial habits

- Avoid debt

- Keep their credit score in good standing

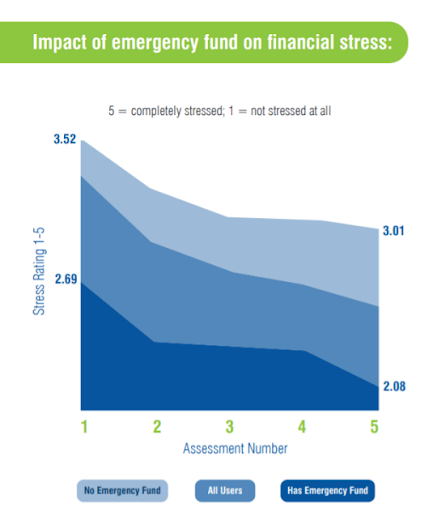

Data shows that 27 percent more participants in iGrad’s partner program, Enrich, built an emergency savings fund after using the platform for 12 months.

To learn more about the importance of emergency funds check out The Impact of Emergency Savings on Student Financial Stress

7. Debt Reduction

Since COVID, college students are taking on more credit card debt. A recent survey9 found that:

- 53 percent of students use two or more credit cards

- 38 percent do not pay off the cards each month

- 40 percent have at least $1,000 in credit card debt

- 14 percent have at least $5,000 in credit card debt

iGrad can help students learn to reduce and manage their debt.

The Enrich data study shows that after using the financial wellness platform for a year, 28 percent more participants pay off their credit cards each month, and 32 percent more are on track with their financial goals.

1 - https://www.collegeatlas.org/college-dropout.html

2 - https://lendedu.com/blog/college-dropouts-student-loan-debt/

3 - https://home.treasury.gov/system/files/136/Best-Practices-for-Financial-Literacy-and-Education-at-Institutions-of-Higher-Education2019.pdf

4 - https://www.tennessean.com/story/opinion/2019/06/25/financial-literacy-first-step-reducing-student-debt/1552205001/

5 - https://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

6 - https://news.osu.edu/70-percent-of-college-students-stressed-about-finances

7 - https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4738080/

8 - https://collegefinance.com/research/money-management-101-how-college-students-are-handling-their-finances

9 - https://www.cnbc.com/2021/05/12/college-students-spending-more-on-credit-cards-.html