Seven out of ten college students are stressed about finances1.

A recent survey2 found that students worry about tuition, living expenses, the job market, and student loan debt.

Other studies3 show that despite the concern, students are not making the best financial choices, such as carrying credit card debt, failing to create and follow a budget, and neglecting to save money for emergencies.

Unfortunately, this stress, along with poor financial decisions, affects their mental health and school performance.

The National College of Health Assessment4 found that students with financial stress are more likely to:

- Get lower grades

- Drop a course

- Drop to part-time student status

- Drop out of school

To help students relieve this stress, students need to become financially well.

Financial wellness is more than just taking a class on personal finance.

Financial wellness means using knowledge about personal finances when making financial decisions. iGrad’s definition of financial wellness is as follows:

Financial wellness is having the knowledge, ability, and desire to make intelligent financial decisions so that one can have the capacity to live a happy life within one’s means.

Offering a Student Financial Wellness Program

One effective way to help students achieve financial wellness is to provide a financial wellness program.

This program will provide the needed education about financial topics as well as the skills needed to apply what they have learned.

The top financial concerns5 among students include:

- Borrowing money for school

- Repaying loans

- Cost of education

- Ability to find employment after school

- Ability to pay for living expenses

When colleges and universities offer a holistic financial wellness program, students can learn the needed skills in the areas in which they struggle.

Implementing a Financial Wellness Program

Over the last decade, organizations providing financial wellness have learned what works best when implementing a financial wellness program.

The most important best practices include:

- Understanding the link between emotional, physical, and financial wellness and providing programs that address all three concurrently.

- Determining the financial needs of your student body. In addition to providing generalized information based on student demographics, successful programs start with a survey to determine specific student needs.

- Use analytics to determine how well the program is working to meet desired goals, outcomes, and behavioral changes.

- Use personalization, gamification, and incentives to engage and motivate student participation.

- Communicate about and deliver the program across a variety of channels for the best response.

Although no specific studies have been conducted to determine the best delivery methods for college students, the 2020 Employee Financial Wellness Report6 does give some insight for colleges and universities.

Delivering Financial Wellness Content

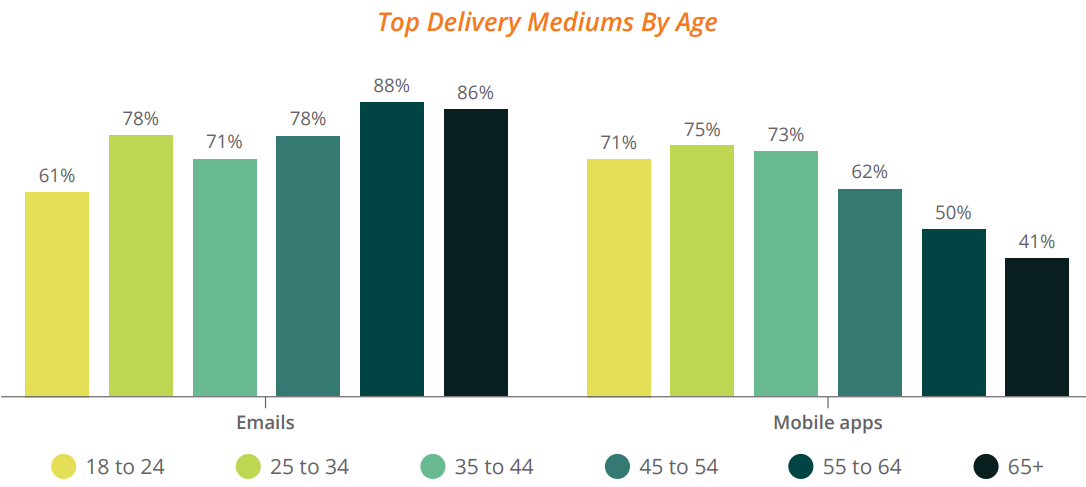

The report asked U.S. employees ages 18 to 70 to choose the top ways they would prefer to interact with financial wellness programs and how they would prefer to receive communications about the program.

Without regard to specific demographics, the top three contenders were emails (76 percent), mobile apps (66 percent), and text messages (36 percent), with individual in-person sessions coming in a close fourth place (35 percent).

When looking at the survey responses by age, the responses are somewhat different.

Those younger than 24 prefer mobile apps to email, while those 25 to 44 prefer email to mobile apps but by a small margin.

Those over 65 prefer email and then individual in-person sessions, knocking texts out of the top three.

What does this mean for institutions offering financial wellness to students?

As you develop a financial wellness program strategy, keep student body demographics in mind.

Although a majority of students may be in the age group that prefers mobile apps, you will have students who don’t feel comfortable using mobile technology.

Offering financial wellness programs and communication through a variety of channels will be the best way to encourage financial wellness participation and engagement among your students.

1 - https://www.wittenberg.edu/sites/default/files/media/celebrationoflearning/2020Virtual/HowFinancesAffectCollegeStudents.pdf

2 - https://s2.q4cdn.com/437609071/files/doc_news/research/2019/young-americans-and-college-survey.pdf

3 - https://everfi.com/white-papers/financial-education/2019-money-matters-report/

4 - https://www.acha.org/documents/ncha/NCHA-II_SPRING_2019_US_REFERENCE_GROUP_EXECUTIVE_SUMMARY.pdf

5 - https://www.inceptia.org/PDF/Inceptia_FinancialStress_whitepaper.pdf

6 - https://www.enrich.org/2020-employee-financial-wellness-report