Award-Winning Financial Literacy Solutions

-

Video-Based Entrance & Exit Counseling test

- Department of Education compliant

- Educates students on federal student loans, payment options, payment plans, consequences of default, and more

- Pre and post-testing

- Detailed, customizable, and real-time reporting

Entrance & Exit Counseling

-

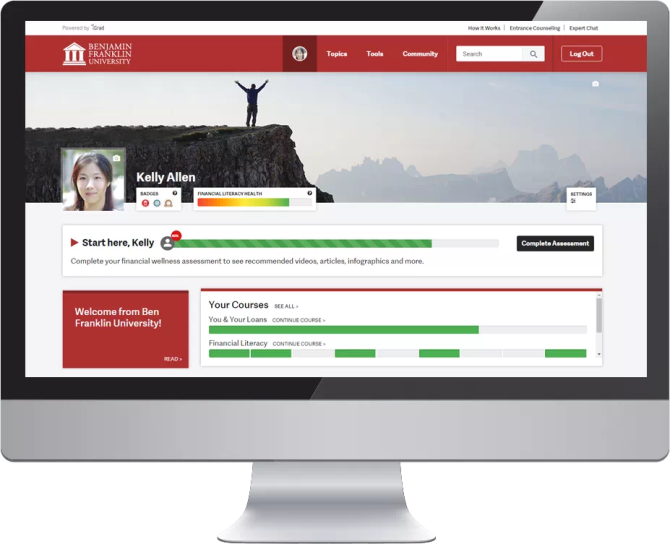

Personalized Financial Literacy Platform

- Financial literacy education that connects over 600 schools & 1.2 million students

- Top Product of 2012, 2013 & 2014, University Business Magazine

- 2013 Outstanding Consumer Information Award, Association for Financial Counseling and Planning Education

Literacy Platform

-

Award-Winning Classroom Curriculum

- Named 2013 & 2015 “Education Program of the Year” by the Institute for Financial Literacy

- Employs 'flipped' or 'inverted' classroom method

- Written by best-selling author Sharon Lechter & Certified Personal Family Finance Educator Angela Totman

Classroom Curriculum

Check out everything that iGrad offers

Best-in-class co-branding

We extend your school's logo and colors to every page of the platform

Insanely customizable

Hide unwanted features and push custom school content to your iGrad site

Seamless integration options

Easily integrated with your school's site(s), including turn-key Single Sign On options

Want to bring iGrad to your school?

Financial Literacy Resources

Here at iGrad we strive to educate administrators on the latest news in student loans, budgeting, career development, and personal finance. Through careful analysis of the latest trends in higher education, we are able to put together provocative resources.

See All Resources

Have a question? We're here to help

Financial Literacy Blog: Bridging the gap between financial literacy and financial capability.

As a longstanding and valued client, the University of Phoenix continues to pioneer financial literacy in higher education. With a deep understanding of the evolving economic landscape, the university is committed to empowering their students.

Read More

Discover innovative strategies to boost student engagement in financial literacy programs. Explore practical tips, from gamification to peer mentorship, tailored to higher-ed institutions. Enhance student success and financial wellness today.

Read More

Beyond financial gains, higher education plays a pivotal role in shaping kinder, healthier, and more financially secure citizens.

Read More

Colleges and universities across the nation are gearing up to address one of the most pressing concerns facing their student bodies: financial literacy. However, addressing the issue requires more than just occasional workshops or resources. Learn more.

Read More