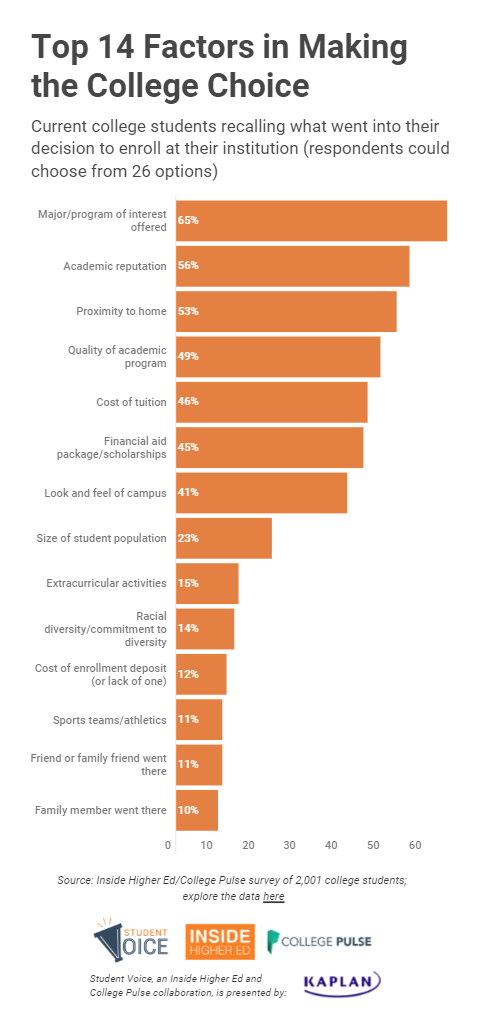

A recent Student Voice survey1 found that prospective students have a strong set of criteria they use when looking for a college – especially since the pandemic.

Students, who were once swayed by where their friends would attend or the alma mater of their parents, now look at much more practical matters.

Source: Inside Higher Ed6

Based on these answers, most students looked at four main categories when choosing their school: location, cost and financial aid, the admissions process, and what the college offers.

Location

There are many reasons prospective students consider a college that is close to home. Here are just a few:

- Homesickness: HAP Balanced living found that over ⅔ of freshman feel severe homesickness2 which leads to poor academic performance and a higher chance of dropping out.

- Less expensive: In-state tuition is less expensive, plus students can save on transportation costs and may also save on housing costs.

- Familiar healthcare providers: Students who live close to home can continue to see their regular physician, dentist, eye doctor, and mental health provider.

In 2019, before the pandemic, The American Freshman3 found that 42% of freshmen attended colleges within 50 miles of their home. At that time, one-quarter of students stated that the location of the college was a very important reason for choosing a college.

Since the start of the pandemic, according to the Student Voice survey, college location has more than doubled in importance with 53% of students finding it to be important.

Tuition and Financial Aid

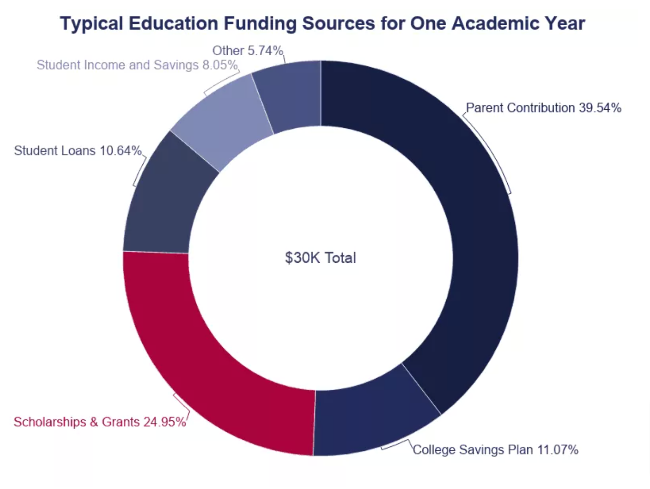

Currently, seven out of ten college students use at least some financial aid to pay for college4.

With parents paying about 40% of yearly tuition costs, students paying 8%, 11% coming from college savings plans, and 10% from student loans, it makes sense for students to consider tuition as well as the financial aid package.

Source: educationdata.org4

iGrad offers a financial aid award analyzer that can help students determine which school is the best deal.

This analyzer looks at direct costs like tuition, fees, room, board, textbooks, and supplies, as well as indirect costs like personal, social, travel, transportation, and health insurance expenses. Then it takes into account all the aid offered by a particular school and includes family contributions, grants, scholarships, loans, work-study, and any other monetary sources used to pay for college.

Such a tool can help students understand what colleges they can afford and which financial aid packages make the most sense given their situation.

Admissions Process

Many admissions processes changed during the COVID-19 pandemic – including waived application fees and optional SAT or ACT testing.

For many students, these changes made all the difference when applying for college and many would like to see such changes remain permanent.

Other changes prospective students liked include:

- Less stringent transcript review

- Optional letters of recommendation

- An easy tuition-refund policy

- A lenient deposit-refund policy

What the College Has to Offer

Finally, students are looking at what a college has to offer. They are asking questions like, “What is the academic reputation of the school?” and “What programs do they offer that fit with my desired occupation?”

They also want to know about the outcomes of students who have graduated from the programs to determine if they are likely to find employment upon completion.

However, students are not just concerned with academics. They are also interested in such things as the social network, on-campus activities, diversity, extracurricular activities, and more.

One way for colleges to stand out from the crowd would be to offer a student financial wellness program.

A recent study5 found that GenZ is more financially savvy than those who came before. However, they are not content to just know more than Millennials and Boomers. Instead, they want to master their financial future.

This includes things like:

- Money management – which includes budgeting, goal setting, and saving.

- Debt management – which includes student loan repayment, credit cards, and building a strong credit score.

- Investing – which includes stocks, bonds, retirement funds, and newer entities such as bitcoin.

Students today think more about the implications of choosing a college. That is why it is important to differentiate your institution from others in ways that are meaningful to prospective students.

1 - https://reports.collegepulse.com/outlook-on-admissions

2 - https://quchronicle.com/74301/opinion/homesickness-and-seasonal-depression-make-life-hard-entering-college/

3 - https://www.heri.ucla.edu/monographs/TheAmericanFreshman2019.pdf

4 - https://educationdata.org/how-do-people-pay-for-college

5 - https://www.raddon.com/sites/default/files/genz-executive-summary.pdf

6 - https://www.insidehighered.com/admissions/article/2022/03/21/survey-student-college-choices-both-practical-and-strategic